In this article I’ll share 7 rules that I religiously follow to achieve success in my trading life. So far it’s been working out well for me for the past 5 years and I hope it will help you up your game as well.

At the end of the article I included a 5-minute video where you can watch over my shoulder how I double my portfolio using these rules. Make sure to read all the way to the end. For my trading demo I used website papertrading.io. I actually use papertrading.io to practice my skills several times per week. I start trading there and don’t stop until I double my money. It helps me a lot to recognize winning patterns and build my experience base. PaperTrading.io is like a gym for my trader mind 🙂

UPDATE: PaperTrading.io is now offering a 7-Day Trial

You Can Sign Up Here: PaperTrading.io 7-Day Trial

Rule #1: Stock Market is Designed To Trick Your Emotions And Make You Lose Money

Stock market is heavily manipulated. If you did not get it yet, it’s time to think about it. Stats are something like this: 95% of traders generally lose money on the stock market while only 5% win in a long run. Stock market is a zero sum game. If you make money this means someone lost the same amount. The same is true vise versa – if you lost money then someone got it. Here is where I’m going to with this – 5% of all traders get money of the rest of the crowd. Think further – if the 95% crowd is losing money then most likely they have something in common. The biggest similarity between them is a group think – they all think very similar. They get excited just before a correction and then they get scared prior to a bull run.

I won’t get into much details on why this is happening. What you need to remember is this… If you feel an urge to buy some stock and can see that everybody else around you is bullish about it – think again, most likely it’s actually time to short it. Same is true the other way – if everybody around you is bearish and you are confident that this stock is about to take a deep dive, maybe it’s time to buy. That’s exactly how 5% of winning traders think. If you want to succeed you need to recognize what the crowd is about to do and do the opposite. Let me finish this rule with one of my favorite quotes that confirms all of the above.

Rule #2: Patiently Wait For A Good Setup Before Buying

This rule is one of the most important ones. A lot of traders trade just because they can and they’re itching to buy something. It’s somewhat rare to find a good setup with the right risk/reward ratio. In my experience setups that work the best are those that confidently go up and then for some reason take a dive to cool down and drop inpationed traders who bought into euphoria at the top and will sell at the bottom. You definitely want to wait for those correction moments and get in when everybody is getting out. If a stock is simply trading sideways you should just say next and focus on other stocks until this one presents a good risk/reward setup.

I learned to recognize those moments after training with papertrading.io for several months. Once you trade over 100 stocks in their system, good setups will be obvious to you. They won’t always work out because Mr Market is unpredictable, but you’ll have skills to quickly close the trade if it’s not behaving in your favor.

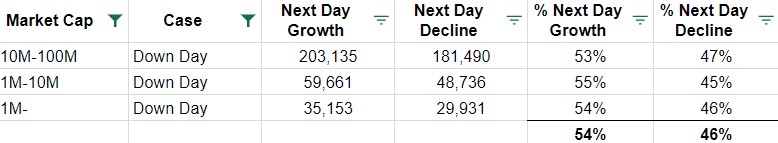

Rule #3: Prefer Buying After a Negative Day

Most traders buy stock after it starts going up. In some cases this could be the right thing to do due to specific patterns or trends, but my general rule of thumb is this – wait for a down day to buy. I discovered that for small cap stocks (Market Cap below 100M) that I prefer to trade for higher returns, stock price is statistically more probable to go up the next day after a decline. There is a 54% chance that stock will go up and only 46% that it will keep going down. You might think that 4% over 50% is not a lot but it’s actually huge in a long run. I back tested this theory on thousands of different stocks. Here is the actual results that I’ve got for a down day.

This rule might sound a bit counterintuitive for you, but remember what happens to those 95% that act intuitively… I suggest you to try it out. Sign up for a trial with papertrading.io and try buying after negative days. You’ll be surprised.

IMPORTANT CLARIFICATION: This rule does not mean that you have to buy after each negative day. You only buy when you are ready to buy (i.e., can see a good setup). When I see a good setup in most of the cases I just wait for a down day and get in.

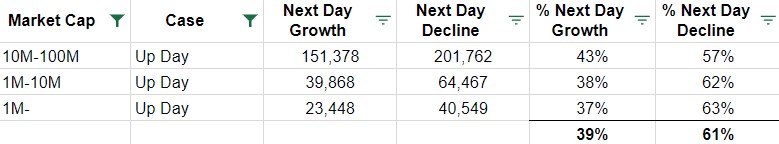

Rule #4: Prefer Selling After a Positive Day

This rule is very similar to the previous one. If you are in a long position and you want to get out, doing that after a massive positive candle is the right thing to do. Odds that you’ll face a decline the next day are 61% comparing with 39% for a chance of growth.

If you don’t trust stats, here is another reason to perform selling after a positive day and vise versa. It’s well known that 95% of traders (that’s that mostly lose) act based on two emotions: greed and fear. This means that they keep holding during up days (greed) and they sell when they get scared on down days (fear). Remember rule #1? If you want to succeed you need to recognize what the crowd is doing and go the opposite direction.

Rule #5: Sell At The Resistance Level

I use this rule a lot and it very often works out. This is my primary sell signal and a huge pillar for trading strategy. You need to be able to recognize a resistance level. Usually it’s somewhat obvious after you gain some experience. When you see that stock approached some price level several times and could not go above that – that’s the resistance level. Also, if, for example, a stock had a consistent run from $20 to $30 and then it hit the wall and went down to $25 you can assume that $30 is the resistance level for this stock. So, if it reversed at $25 and started going up again, you can expect that it will be struggling when approaching $30 level again. In the scenario above if I was able to recognize that reversal at $25 level and picked it up, I’ll be selling at $30- level (slightly below $30).

A lot of traders hope that their stock will break through the resistance level and then wildly go up. In some cases that’s exactly what happens, but in my experience I saw much more often that stock would go down after reaching the resistance level.

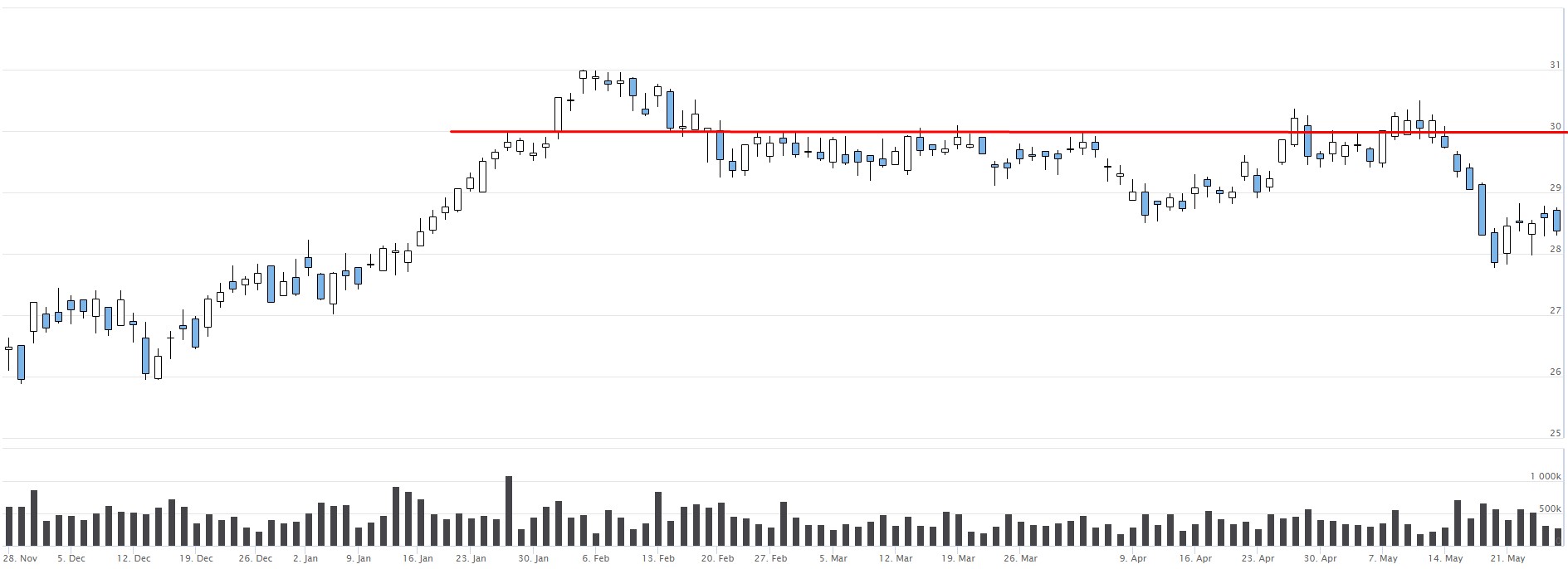

Here is an example of a resistance level at $30.

The chart above is actually a good buy point that fits 2 rules that we’ve already discussed:

- Rule #2: Patiently Wait for a Good Setup: this stock reached $30 back in January and was trading sideways for a long time. After 4 months it corrected by almost 10% from $30+ to $28-. Moreover, here at around $28.40 my downside would be only 40 cents as it seems to have a support at $28. But my upside is almost $2 ($1.6 to be precise) because it might easily grow to $30 (it might go even higher but I know I’ll sell at $30 waiting for another correction or a clear break out). So, I’m risking only $0.4 and my potential reward is $1.6 which 4 times better than the risk I’m taking.

- Rule #3: Prefer Buying After a Negative Day: last day was indeed a negative day and there is a 54% chance it will go up tomorrow.

Rule #6: Buy At The Support Level

This rule is very similar to Rule #5, but this time you need to be able to recognize a support level. At the support level traders start buying and don’t let it go down even deeper. A lot of the times resistance level becomes a support line after a stock made it through the resistance.

Here is an example of a support level.

Rule #7: Practice Every Day via Paper Trading

This one is probably my biggest secret – I practice trading a lot. If you want to get into 5% of winning traders you need to have some edge comparing to 95% of traders who lose. If you only read books / news – that’s not enough. All traders do. The biggest difference between winning and losing traders is experience. My game level completely changed since I started using papertrading.io as my trading gym. They offer thousands of different stocks and decades of historical data. Cool thing is that you don’t have to wait for a long time to see what your stock did the next day. You simply click “Next Day” Button and you are there. In 1 hour you can trade several years of data for a dozen of different stocks. That’s really impressive. They offer a 7-day trial if you want to try them out. After that it’s only $19.95/mo, but trust me – you get so much more value out of it… You’ll see what I’m talking about when you start practicing! 😉

>> Click Here To Try PaperTrading.io

As I mentioned before, the way I train is I login to papertrading.io and trade until I double my money. The more I train, the less it takes for me to double and less mistakes I make on my real trading account. Here is the video of one of my practice sessions. It usually takes me 10-15 minutes to double portfolio. This time I made it a bit quicker. Enjoy!

[VIDEO] Watch Me Over The Shoulder How I Double My Portfolio Using My 7 Rules for Successful Trading

Gain At Least 5 Years of Experience Or Get Your Money Back!

They offer a stellar guarantee – if you don’t feel that you gained at least 5 years of trading experience after practicing for a few weeks, they’ll give you money back. No questions asked! Your satisfaction is 100% guaranteed. Sign Up For a 7-Day Trial!